US Manufacturing is Doing Just Fine

Provided the US retains its open posture to the exchange of goods, people, and services, American manufacturing should continue to prosper.

My recent attempt to steer Helen Andrews away from her NAFTA skepticism unfortunately appears to have come up short. Instead of reconsidering her opposition to the 1994 trade agreement, the American Conservative writer has issued a surrebuttal to my March 13 defense of NAFTA that alleges two errors on my part. The first is that I believe the current state of trade and the World Trade Organization (WTO) to be “nothing new” and little changed from what existed previously.

The second (and more interesting) claim is that—contra my documented assertions—perceptions of US manufacturing strength are largely owed to deceptively positive statistics. Properly gauged, the sector exists in a much more perilous state—and trade is largely to blame.

Allow me to address both.

Andrews’ first claim is easily debunked. While she is correct that trade and the institutions that promote cross-border exchanges have changed in important ways, it’s also irrelevant as I never said otherwise. Just check the tape:

But the idea that 1994 heralded a new economic era is a strained interpretation of events. Put more bluntly, it’s false. Globalization—the process of increasing international economic integration—has been underway for centuries, if not millennia. (The first evidence of long-distance trade dates back to 3000 BCE) Sometimes it has ebbed (the outbreak of the world wars) and other times it has flowed (the Age of Discovery and the Industrial Age) but the direction has long been toward more expanded linkages. Indeed, each of the items cited by Andrews weren’t revolutionary events but further evolutions of events long underway.

The European Union, for example, was the successor to the European Community, which in turn traces its origins to the European Coal and Steel Community. The World Trade Organization, meanwhile, was preceded by the General Agreement on Tariffs and Trade (GATT), which had successfully reduced tariffs around the world through a series of negotiating rounds spanning many decades.

Very plain is an admission that the WTO and other trade developments were a departure from the status quo. I simply characterized them more as evolutionary than revolutionary and the advancement of trends long underway. Notions I believe the WTO to be indistinguishable from the GATT or that no changes of note have taken place in the trade arena are inaccurate and unsupported. Indeed, I count myself an avid supporter of globalization’s rising tide witnessed in recent decades. I simply take issue with her characterization of 1994 as a dramatic departure from what came before or an inflection point.

But that’s minor stuff.

The heart of Andrews’ response rests on an entirely different claim. While I pointed out in my original piece that manufacturing job losses were more a story of productivity gains and changing consumer tastes than trade, she argues that this is a story rooted in misleading data. But before getting to that, let’s first look at what I wrote:

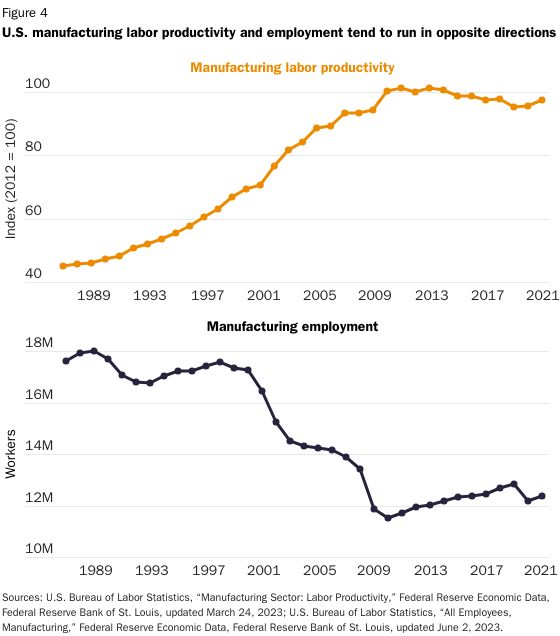

But NAFTA’s claimed role is ahistorical, and blame placed on globalization for manufacturing job losses is mistaken. The decline in US manufacturing jobs—something that has been taking place since 1979—is more a story of technology (robots, computers, and the like) and changing US consumer tastes than it is about trade. We know this because while the number of manufacturing jobs has declined, output has risen. Manufacturing jobs have declined abroad too, even in China. More recent US manufacturing job gains, meanwhile, have been accompanied by stagnant industrial productivity. Most lost manufacturing jobs were claimed by automation and economic development, not Mexico and China.

Andrews counters that the rise in manufacturing output is largely a statistical quirk. Citing the work of economist Susan Houseman, Andrews argues that these gains were largely due to impressive increases in a single subsector—computers—and more reflected qualitative improvements in the products than production efficiency gains. Once computers are stripped out of the data, a bleaker manufacturing picture emerges.

“We weren’t making more stuff with fewer people,” Andrews writes. “[W]e were making less stuff.”

The assertion is false. As Houseman herself stated in a 2016 interview, manufacturing output was about 8 percent higher than in 1997 even with the computer industry excluded. Meanwhile, manufacturing employment declined over the same period by nearly 30 percent (approximately 17 million versus 12 million). That’s certainly making more stuff—modestly more, to be sure—with significantly fewer workers.

More importantly, while Houseman’s observations about the computer sector’s outsized contributions to output are interesting, they hardly invalidate US manufacturing’s performance in recent decades—especially when compared to other countries (which would face similar data issues). Computers are not a trivial or unimportant part of the US manufacturing sector. Just as their inclusion arguably paints a somewhat skewed picture, so would their exclusion.

Indeed, what’s the limiting principle to such logic? Would eliminating sectors that, due to changing societal or technological trends (trends that have nothing to do with trade), exert a disproportionate drag on manufacturing performance provide a more accurate portrayal of the sector’s health today?

For example, from 1997 to 2018 smoking rates among US adults nearly halved. Not surprisingly, US tobacco product manufacturing also experienced a sharp (nearly 73 percent) decline in real value-added. Similarly, decreases in paper and paperboard consumption in recent decades (When’s the last time you read a physical newspaper?) correlate with a 36 percent decline in the sector’s real value-added.

Should these and other manufacturing industries that have declined or disappeared through no possible fault of trade (the trend of dematerialization, for example) be excluded from the sector to produce a more accurate sense of domestic manufacturing’s resilience—one that would cast it in an even better light? Once one begins making such data adjustments, there’s no logical end.

Other issues related to changes in the US and global manufacturing sectors also bear consideration. As has long been observed, for example, the United States is a services-based economy, with Americans devoting an increasing amount of their spending to services rather than stuff. More money—resuming a pre-pandemic trend—is going to items such as dining out and travel than new appliances (one can only have so many refrigerators and microwaves, after all).

Given this trend, continued “dematerialization,” and other countries’ growth and industrialization (mostly devoted to serving their domestic markets), even a flatlining of US manufacturing output at its record level would be respectable. Indeed, in the face of these trends and others, it’s wholly unrealistic to expect US manufacturing output to post healthy increases ad infinitum.

And yet that always seems to be the assumption that protectionists demand free traders rebut.

None of this is to argue that trade doesn’t affect US manufacturers or that it wasn’t a factor in the historic decline in US manufacturing employment (hence my original statements that it was more a story—although not entirely one—of technology than trade and that most manufacturing jobs losses were due to automation and economic development). Of course, it was. It is wildly simplistic, however, to argue—as Andrews did—that NAFTA was passed, globalization ran rampant, and 5 million manufacturing jobs went poof with an implied monocausal relationship.

Trade was a part of the employment story, but only a part. More important were productivity improvements, especially over the long term. As economist Robert Lawrence has argued, relatively faster productivity growth is the “dominant force behind the declining share of employment in manufacturing in the United States and other industrial economies.”

The steel industry offers a good example. While the number of workers in the industry declined by 79 percent (399,000 to 83,000) from 1980 to 2017 production rose by 8 percent. In contrast, only 16 percent of the decline in manufacturing employment between 2000 and 2007 has been attributed to increased imports from China.

Notably, some of Andrews’ numbers speak to productivity’s impact. While she points out that manufacturing productivity decreased between 2011 and 2022, left unsaid is that hiring in the sector during this period went up. That’s entirely consistent with the notion that productivity is a key determinant of manufacturing employment.

Perhaps this helps explain why Houseman’s critiques haven’t gained greater currency or led to significant revisions of how government number crunchers assess the manufacturing industry.

Free trade critics find themselves in a difficult position. Faced with the increased prosperity that has correlated with lowered trade barriers, making the case that trade liberalization has led to widespread harm is no easy task. This necessitates more imaginative claims, such as that freer trade is responsible for illegal immigration, rising obesity in Mexico, and—if you squint your eyes just right—that domestic manufacturing has suffered from trade liberalization. But US manufacturing, just like the economy more broadly, is doing largely fine. A sector that accounts for a greater share of global output than any country save China, exported nearly $1.6 trillion in 2022, and has over 600,000 job openings is a poor poster child for globalization’s alleged ills. Provided that the United States retains its relatively open posture to the exchange of goods, people, and services, American manufacturing should continue to prosper for decades to come.