What Virginia’s I-81 Says About the Future of U.S. Freight

Decisions made on the key stretch of interstate could, for better or worse, foretell how goods are moved elsewhere

I’m standing at a gas station parking lot in Raphine, VA—the heart of Virginia freight trucking country. The station is Pilot Travel Center, one of North America’s leading chains for serving truckers. Across the road is White’s Travel Center, an even bigger truck stop. Sitting between is where this industry does its work: Interstate 81, or as it is typically known, I-81.

The 325-mile portion that stretches through the Shenandoah Valley and southwest Virginia is among America’s key stretches for moving Southern manufactured goods to Northern cities, and vice versa. It has 48,000 vehicles on average daily, and freight tons in the hundreds of millions annually.

This means I-81 has congestion, and there are calls to increase capacity. It mirrors the dialogue happening nationally about the proper approach to expanding interstates. For that larger picture, let’s step outside Virginia for a bit.

The reason for I-81’s crowding is where it fits in the U.S. supply chain.

Many of the raw materials that eventually get made into finished goods come from out West. The five states with the most oil production are all Western states. Texas more than triples the production of 2nd-place North Dakota. The states with the most prime farmland are Kansas and Nebraska. The U.S.’s top two trading partners are Canada and Mexico, and the states that their imports most commonly pass through are, respectively, Michigan and Texas. A lot of those imports are raw materials too, such as crude oil.

These raw materials then move further east, where they’re manufactured into products. According to a report by Area Development, the 10 U.S. states where manufacturing as a share of employment is highest are all in the South and Midwest. The products are then shipped for consumption to metro America, which centers disproportionately east of the Mississippi River, and is particularly centered in the Northeast.

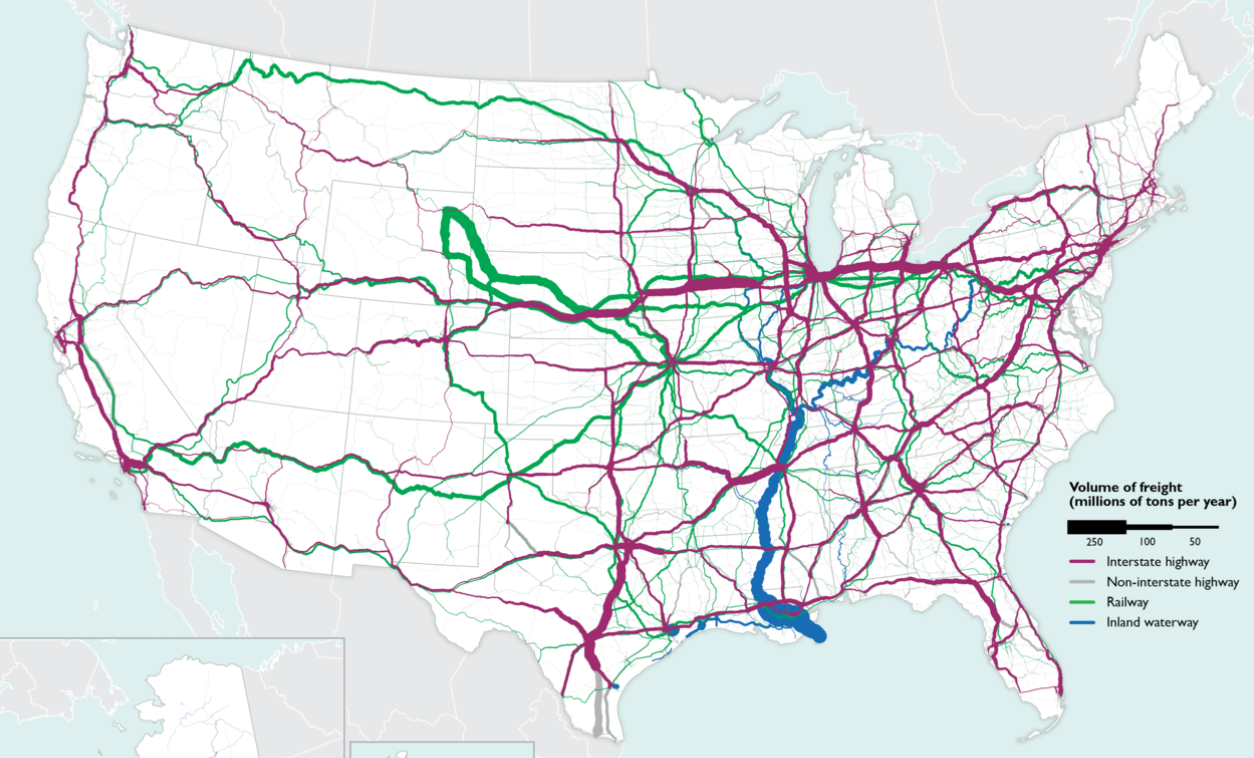

This west-to-east supply chain informs the movement of freight goods—with 71% of those goods moving by truck. As this U.S. DOT map shows, the most intensive truck routes (which are drawn in burgundy, with thickness denoting freight volume) move either from Texas through the South and up the East Coast; or from the Great Plains through the industrial Midwest into the Northeast.

I-81, which mostly runs through Virginia, Pennsylvania, and New York, is a supplement to other interstates on the south-to-north path. It isn’t America’s most busy freight route, but the Virginia portion, in particular, is robust. Interstate 95, which is thought of more in the national imagination as a major transport spine, actually doesn’t carry as much freight as I-81 does along their parallel routes.

Part of this is due to I-95’s tolls and congestion (from regular traffic), whereas I-81 goes more through rural areas. But it’s also because I-81 is a straighter path between the production that occurs in Mexico, Texas and Southern states, and consumer markets in the urbanized Northeast.

That is why congestion has increased in its own right along I-81. An increase of 55% in five years, as have safety hazards. Drive along the Virginia portion and you’ll see: it functions like the trucker version of a NASCAR race, with 18-wheelers darting in and out of crowded lanes to pass each other. While some common commuter traffic comes during rush hour out of Roanoke, I-81 has the highest ratio I’ve seen, anecdotally, of freight trucks to standard vehicles. On busy days, the share of trucks can exceed 50%.

There’s a lot of congestion, a lot of speeding when the congestion dissipates—and a lot of accidents. A report from FreightWaves, which covers industry news, finds that on interstate highways nationwide, 16% of delays are caused by incidents and accidents. But on I-81, the figure is 51%.

It seems, from the perspective of those interested in free markets and economic growth, that I-81 needs improvement. The widening of the interstate would increase capacity and allow the separation of freight from normal traffic. Having tolled express lanes and variable pricing would allow demand to spread out across different parts of the day. The toll revenue would also enable, better than state and federal gas taxes have, the repair of I-81, which was never meant for this level of truck volume anyway.

For a while, the Virginia state government had a set of plans. A $2 billion I-81 Corridor Improvement Program was proposed that would include tolls, so the road could generate revenue for self-maintenance, but the tolls were eventually struck from the proposal due to truck industry lobbying. Instead, the plan will be funded by a gas tax increase that hits all Virginians—regardless of whether they use I-81—and that won’t provide nearly as reliable revenue.

Hopefully, this episode doesn’t foreshadow the strategy for America’s other interstates.

Highways like I-90, which spans the northern part of the country, or I-35 through Texas, are dealing with even greater capacity shortfalls. Tolling is sporadic on these roads, and expanding toll infrastructure would help fund needed repairs and expansions. If states don’t do that, they’ll deal in the long-term with even greater congestion, safety, and maintenance issues than Virginia’s I-81 does.

Already, congestion costs the U.S. economy $87 billion annually, and much of it occurs on these freight routes.

Tolls or no tolls, I-81 has been a useful piece of infrastructure. Along with moving crucial goods cross-country, it has brought economic development to an area of the state that’s historically been rural and poor. Hopefully, it will continue in the coming years to serve as one of America’s crucial transport and logistical spines. (Learn more about market-based transport ideas in Street Smart: Competition, Entrepreneurship, and the Future of Roads, Edited by Gabriel Roth.)

Catalyst articles by Scott Beyer | Full Biography and Publications