‘Elasticity’ Key to Solving U.S. Urban Housing Crisis

Some U.S. metros have stayed affordable by building lots of housing. They provide a lesson for California—and for states receiving its expats

America’s coastal urban housing crisis is spreading inland. In a recent New York Times piece, Conor Dougherty highlights how Californians are fleeing to Idaho, and the fears that this might increase rents there, with home prices already rising 20% last year. Similar concerns have been expressed in Arizona, Texas, and other states receiving these expats. Can they import Californians without importing their housing problems?

Many people in the receiving states seem skeptical. As Boise mayor Lauren McLean, speaking on the housing issue, told the Times, “I can’t point to a city that has done it right.”

But the mayor’s statement is simply incorrect. Census data shows that many large U.S. metros indeed grow quickly while stabilizing home prices. Their lessons should not only inform places like Boise, but can help stop the bleeding in super-expensive Los Angeles. The key is to keep their housing markets “elastic.”

Elasticity is an economic term meaning that supply keeps pace with demand; inelasticity means supply remains below demand. Census data suggests that a metro’s housing elasticity levels may be the biggest factor in its affordability.

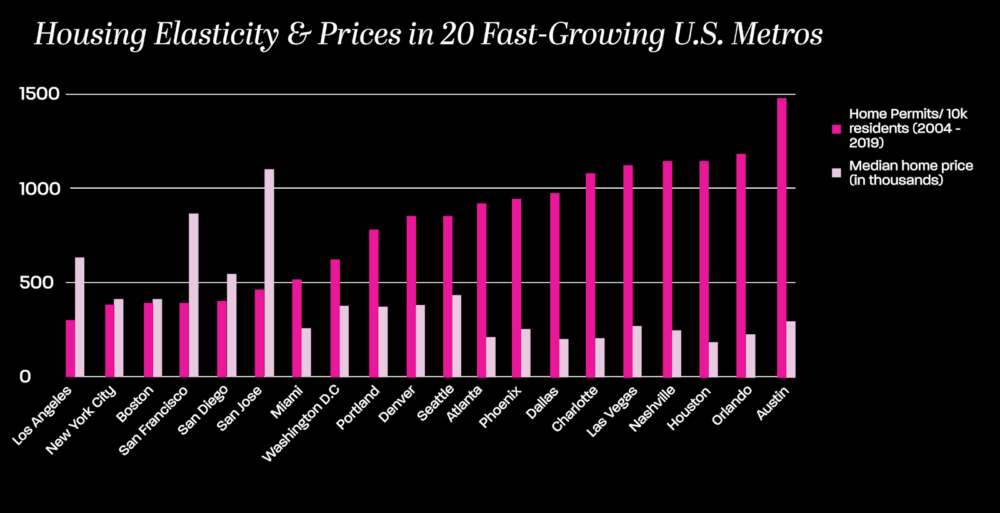

The bureau’s Building Permits Survey tracks how many permits are issued in each U.S. metro annually. In a 2020 Catalyst piece, I used the data to measure elasticity in 20 fast-growing large U.S. metros, calculating their permits per 10,000 population from 2004-2019. Then I compared their median prices.

The results were telling. The ten least-elastic metros read like a who’s who of America’s most expensive metros, with Los Angeles ranking as least-elastic, followed by New York City, Boston, San Francisco, San Diego, and San Jose. All those metros have median home prices above $400,000, some by a wide margin.

The most elastic are generally Sunbelt metros like Austin, Orlando, and Houston. Each has similar or higher population growth as their inelastic coastal rivals, but their median home prices are all below $300,000.

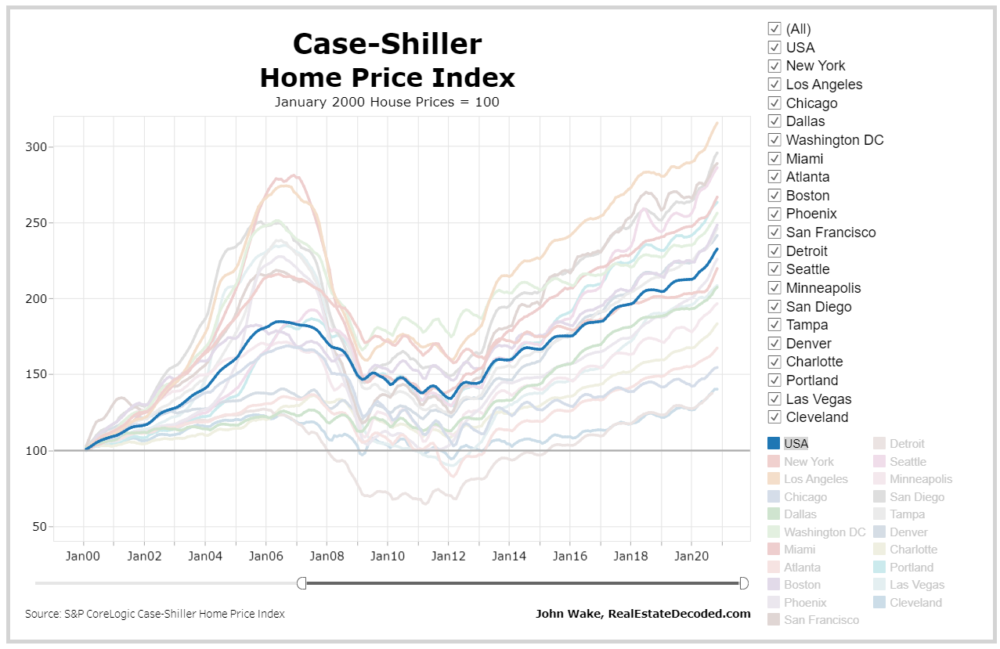

The Case-Shiller index, which measures home price appreciation in 20 metros, makes a similar point about elasticity or lack thereof. Since 2000, the metros where home prices rose the fastest are, in this order, Los Angeles, San Diego and San Francisco. Among the metros with price appreciation below the national average include, once again, fast-growing but elastic ones like Dallas, Charlotte and Atlanta.

Houston—whose median home values are only 76% of the national average—stands out. Since 2010, it has had America’s 2nd-highest net population growth but is #1 in permits issued. This has made it an affordable city even in core locations; 1-bedroom, 1-bath downtown condo units can be found for under $200,000.

How does Houston remain so elastic? Less regulation. The city famously lacks a zoning code, and many of its suburbs are also very pro-growth. This means it has fewer legal barriers to more housing than inelastic coastal metros, where proposed zoning changes can trigger lengthy and contentious review processes.

Some might argue that Houston’s affordability results from its excessive sprawl. But at least one example exists of a dense metro that also has high elasticity, high demand, and lower prices—Tokyo.

In the 1980s, Tokyo and other Japanese cities were experiencing an economic boom that was inflating home values. Beginning then, and continuing for several decades, Japan weakened local zoning laws from the national level. The result: more housing and lower prices, particularly in Tokyo.

From 2003 to 2015, the megacity added nearly 1.5 million people, and allowed over 100,000 annual housing units. That is nearly double metro New York City and 8 times San Francisco. Tokyo’s median home price is $308,000, far below comparable U.S. cities like New York and San Francisco, and Asian cities like Singapore and Hong Kong—all of whom permit far less housing.

Tokyo’s experience debunks the fatalistic assertion that dense, job-rich, wealthy cities are doomed to unaffordability—or, even more fallacious, that building more drives home prices up. The U.S.’ fast-growing elastic metros debunk this notion too. Yet the conventional wisdom in urban American planning discourse is that U.S. cities “can’t build their way out of the housing crisis.” Mayor McLean’s Times quote echoed that sentiment, as if housing is some impossible riddle that is immune to economic laws.

But the data shows that more building stabilizes prices. Cities like Los Angeles—and the states to which it is exporting people—can, in fact, accept growth without raising rents. It requires the political courage to loosen zoning and allow more housing, just as America’s elastic metros do.

Catalyst articles by Scott Beyer | Full Biography and Publications